Tax Fees and Liability Accounts

The QuickBooks Online integration from PowerSync supports native Magento tax processes and configuration. In addition we are happy to say we also support AvaTax Magento integration. This document covers various ways for you to configure the integration.

Basic Setup

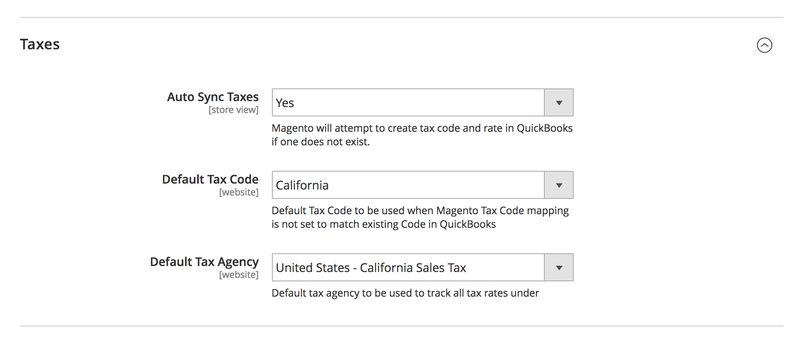

If you would like to capture taxes in QuickBooks Online in the simplest from, all you have to do is to follow these steps and set a few default values in Magento configuration. The configuration section is located in Stores > Configuration > TNW QuickBooks > Orders Taxes (section)

- Tax Rates from Magento will automatically synchronize with QuickBooks Online if you enable "Auto Sync Taxes" feature.

- "Default Tax Code" will show you a list Tax Rates defined in your QuickBooks Online

- "Default Tax Agencies" will give you a list of all Tax Agencies you have available in your QuickBooks Online.

NOTE: these settings are the default settings Magento will use if no other rules are applied. Think of this is a catch-all rule for all taxes fees coming from Magento.

Advanced Setup

(assumes the Basic Setup is completed)

There are many Tax Agencies all over United States. You may need to think about being able to report fees collected. We have a flexible configuration allowing you to "link" a Tax Agency from QuickBooks back to all orders captured for an entire country, a state or a Province, and even a city. Example below will show you how to configure Magento to be able to capture all tax fees collected in Arizona State under the "Department of Revenue" tax agency. NOTE: this is just an example and the name of the Tax Agency or a Liability Account might be different.

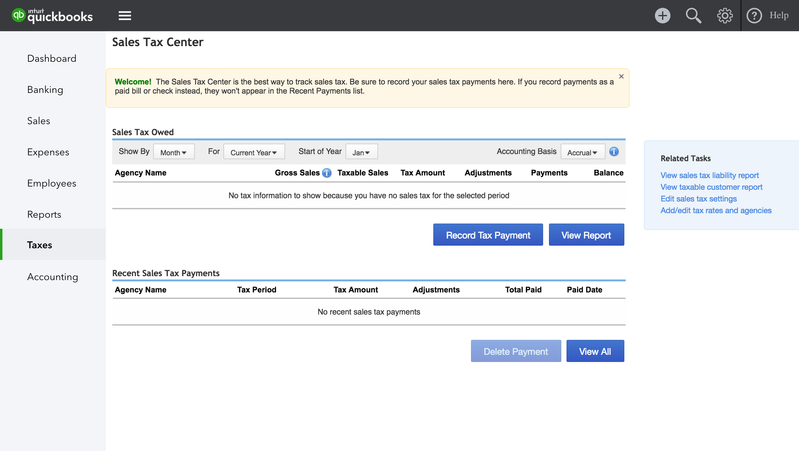

- QuickBooks Online

- Navigate to "Taxes" tab on the left side

- On the right hand side you will see a small list of links. Click on "Add/edit tax rates and agencies"

- You will see the list of all Tax Rates you have configured.

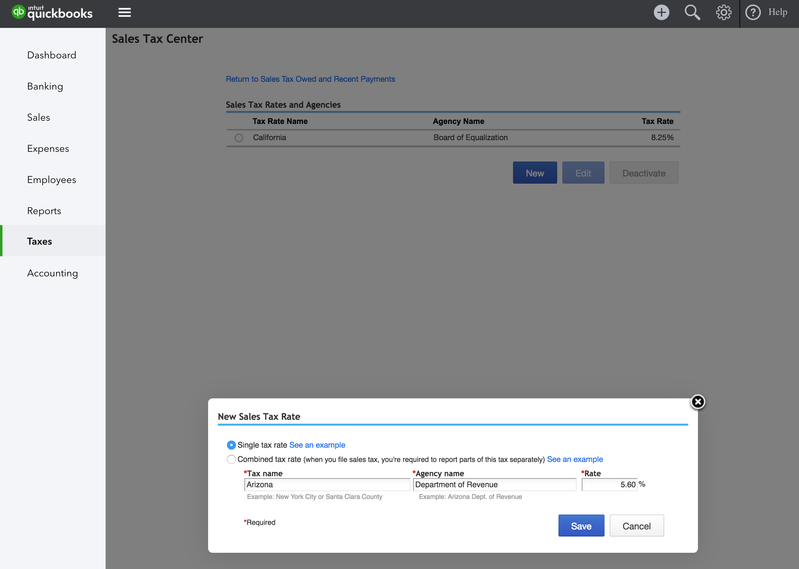

- Click on "New" button to add "Arizona"

- Enter Tax Name, Agency Name, and Tax Rate

- Click on "Save"

- Navigate to "Taxes" tab on the left side

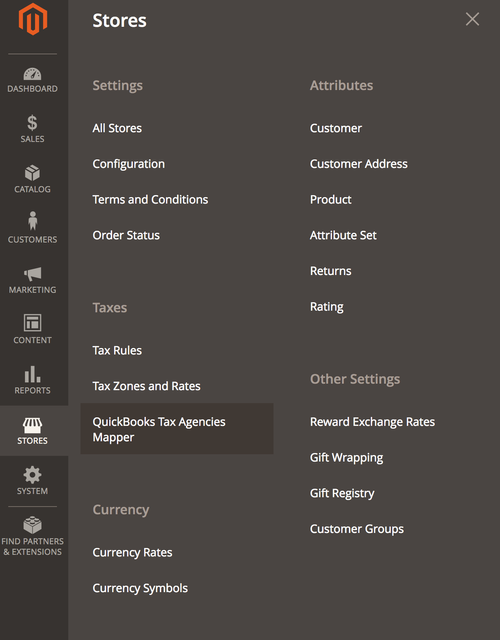

- Magento Admin Panel

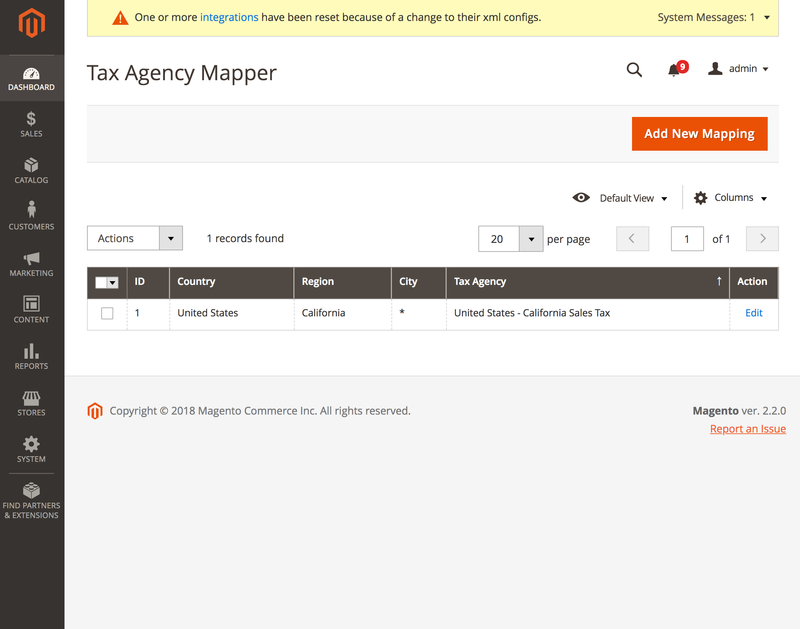

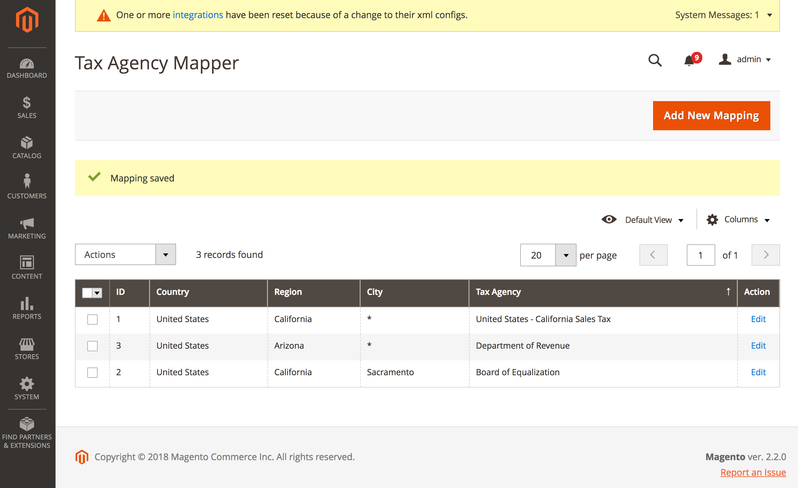

- Under Stores > Taxes (section), you will notice a new menu item: QuickBooks Tax Agencies Mapper

- You will see a page list all tax rules for QuickBooks Online

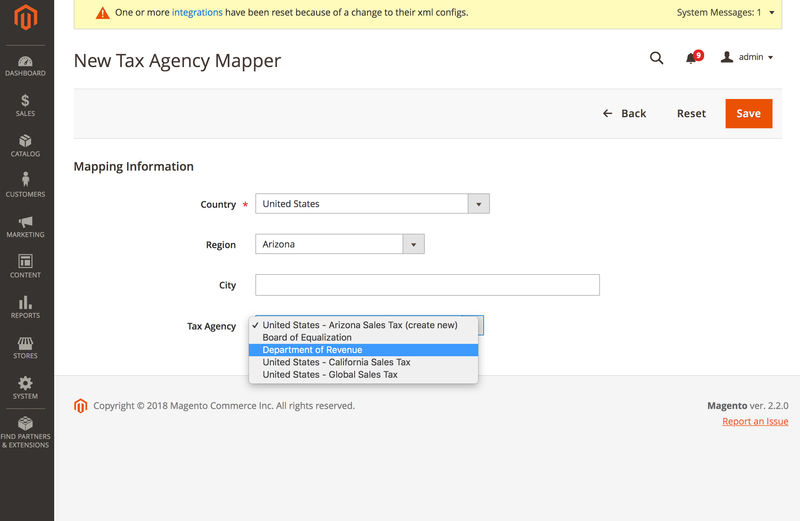

- Click on Add New Mapping

- Fill our the form per the screenshot below

- Country: United States

- Region: Arizona

- City - leave blank (for this example)

- Tax Agency - you will see Department of Revenue (this is the Tax Agency we just created in the previous step in QuickBooks Online)

- Click Save

- Under Stores > Taxes (section), you will notice a new menu item: QuickBooks Tax Agencies Mapper

Related articles

Filter by label

There are no items with the selected labels at this time.